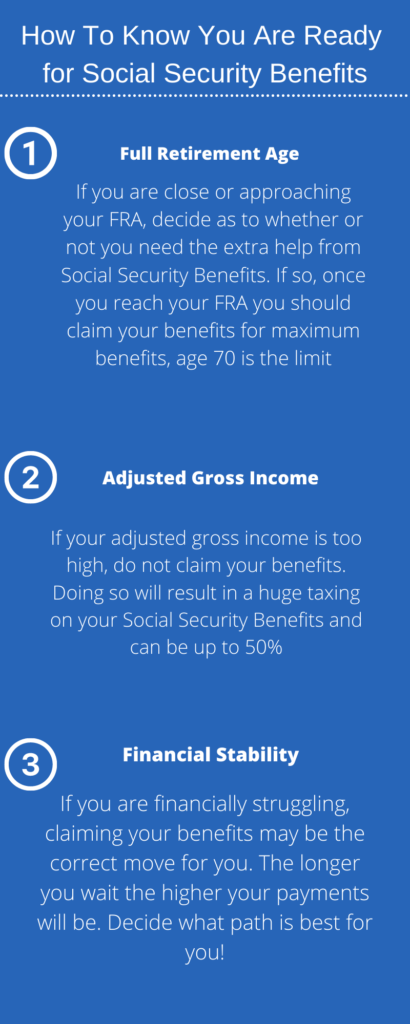

19 Mar How To Know You Are Ready for Social Security Benefits

Throughout your lifetime you are required to be paying into Social Security Taxes. Eventually the time will come to where you want to regain that balance you have been paying that will help you greatly throughout your life after retirement. There are many steps that are crucial to having a successful retirement plan and knowing the necessary steps to take just before claiming Social Security. Here we will be covering what signs you should be noticing that tell you are ready for Social Security Benefits

The first sign is your age. For those who were born in the year 1960 or after, your FRA is set at 67 years. Those born prior to 1960 will all have separate full retirement ages. For example, if you were born in 1957 your FRA would be 66 and ½ or 6 months old. The FRA for each year from 1959 to 1955 is different by two months. The maximum age in which you should claim your Social Security benefits is age 70.

Another sign is your AGI or adjusted gross income. If your AGI is too high then there is a large possibility that you will be paying a huge tax on your social security benefits. This also depends on whether you are single and or married, income levels vary for both. With this in mind, being able to recognize whether or not you exceed the income limit is a very important piece to know. If you are to know in advance you are exceeding the limit, then you are not ready for social security benefits as you will also be receiving a heavy tax on these benefits which sometimes can be up to half!

A common route that some couples take when both approaching their retirement ages are claiming their Social Security benefits at different ages. This happens often if a couple decides they will need their retirement benefits sooner due to current obstacles they are facing and decide to let the other claim their benefits at their FRA for the full amount of benefits.

For example, one spouse claims their retirement benefits at age 65 and the other claims theirs at 70 years old to help cover them financially for the time being. Doing so can help to cover more years while spreading your benefits out and not relying on both accounts of Social Security benefits at the same time from the start. With that in mind, both spouses could also wait till age 70 to both claim their benefits and doing so at age 70 would drastically increase their benefits combined by almost ¼.